NEW YORK (AP) — Another day of big losses knocked U.S. stocks to their lowest levels in more than a year Monday.

Selling was widespread. Investors dumped high-growth technology and retail companies as well as steadier, high-dividend companies. Hospitals and health insurers slumped after a federal judge in Texas ruled that the 2010 Affordable Care Act is unconstitutional.

The Dow Jones Industrial Average fell 507 points after a 496-point drop Friday, and all the major stock indexes fell at least 2 percent. Oil closed below $50 a barrel for the first time since October 2017. Bonds rose and their yields fell.

Mark Hackett, chief of investment research at Nationwide Investment Management, attributed Monday’s action in stocks to investor concerns about the slowing global economy. But he felt it was overdone. “That is basically retail investors panicking,” he said. “Investors basically are confusing the idea of a slowdown with a recession.”

Investors sold almost everything. Less than 40 of the 500 stocks comprising the S&P 500 finished the day higher. Amazon led a rout among retailers and tech companies including Microsoft turned sharply lower. Some of the largest losses went to utilities and real estate companies, which have done better than the rest of the market during the turbulence of the last three months.

The S&P 500 index, the benchmark for many investors and funds, finished at its lowest level since Oct. 9, 2017. It has fallen 13.1 percent since its last record close on Sept. 20. The Russell 2000, an index of smaller companies, has dropped more than 20 percent since the end of August, meaning that index is now in what Wall Street calls a “bear market.”

Germany’s main stock index also fell into a bear market Monday as companies like Siemens and SAP kept falling.

Smaller U.S. stocks have taken dramatic losses as investors have lost confidence in the U.S. economy’s growth prospects. Smaller companies are considered more vulnerable in a downturn than larger companies because they are more dependent on economic growth and tend to have higher levels of debt.

Hackett said the current drop is similar to the market’s big plunge in late 2015 and early 2016, which was also tied to fears that the global economy was weakening in a hurry. But even though the economy is slowing down after its surge in 2017 and 2018, it should continue to do fairly well.

“It’s a slowdown from extremely high levels to healthy levels,” he said. “The globe isn’t going into a recession.”

The S&P 500 skidded 54.01 points, or 2.1 percent, at 2,545.94. The Dow Jones Industrial Average lost 507.53 points, or 2.1 percent, to 23,592.98. The Nasdaq composite fell 156.93 points, or 2.3 percent, to 6,753.73. The Russell 2000 index dipped 32.97 points, or 2.3 percent, to 1,378.14.

Following the health care ruling, hospital operator HCA dropped 2.8 percent to $123.1 and health insurer UnitedHealth lost 2.6 percent to $258.07. Centene, a health insurer that focuses on Medicaid and the Affordable Care Act’s individual health insurance exchanges, fell 4.8 percent to $121.42 and Molina skidded 8.9 percent to $120.

Many experts expect the ruling will be overturned, but with the markets suffering steep declines in recent months, investors didn’t appear willing to wait and see.

Benchmark U.S. crude fell 2.6 percent to $49.88 a barrel in New York. Brent crude, used to price international oils, dipped 1.1 percent to $59.61 a barrel in London. Weaker economic growth would mean less demand for oil, and traders have been concerned there is too much crude supply on the market. That’s chopped oil prices by one-third since early October.

Bond prices rose. The yield on the 10-year Treasury note fell to 2.86 percent from 2.89 percent.

The Federal Reserve is expected to raise interest rates again Wednesday, the fourth increase of this year. It’s been raising rates over the last three years, and investors will want to know if the Fed is scaling back its plans for further increases based on the turmoil in the stock market over the last few months and mounting evidence that world economic growth is slowing down.

Hackett, of Nationwide, said investors will be happy if the Fed adjusts its plans and projects fewer increases in interest rates next year. But he said investors might be startled if the Fed decides to not raise rates this week.

British Prime Minister Theresa May said Parliament will vote Jan. 14 on her deal setting terms for Britain’s departure from the European Union. She canceled a vote on the deal last week because it was clear legislators were going to reject it. May insists she can save the deal, but pressure is mounting for either a vote by lawmakers or a new referendum on the issue.

Britain is scheduled to leave the EU in late March, and if it does so without a deal in place governing its trade and economic relationships with the bloc, it could bring huge disruptions to the British and European economies and financial markets.

Germany’s DAX lost 0.9 percent. That means the DAX, which represents Europe’s largest single economy, is also in a bear market. France’s CAC 40 and Britain’s FTSE 100 both fell 1.1 percent.

Japan’s Nikkei 225 index added 0.6 percent and the Kospi in South Korea gained 0.1 percent. Hong Kong’s Hang Seng was less than 0.1 percent lower. Both the Kospi and Hang Seng are in bear markets as well.

In other energy trading, wholesale gasoline shed 1.7 percent to $1.41 a gallon and heating oil slid 1 percent to $1.83 a gallon. Natural gas dropped 7.8 percent to $3.53 per 1,000 cubic feet.

Gold rose 0.8 percent to $1,251.80 an ounce. Silver added 0.8 percent to $14.76 an ounce. Copper dipped 0.3 percent to $2.75 a pound.

The dollar slipped to 112.75 yen from 113.29 yen. The euro rose to $1.1350 from $1.1303. The British pound rose to $1.2629 from $1.2579.

https://www.apnews.com/bd739b64af9e4e6fa1653842d7f38f98

<2

Chinese tech start-ups are tapping into Southeast Asia amid tough relations with US in trade war, NYSE executive says

‘Southeast Asia is one of those areas where it has been explored before, but now there is that new focus,’ says Betty Liu, executive vice-chairwoman at NYSE

A shift would challenge US markets to draw more companies from China, which has become a growth engine

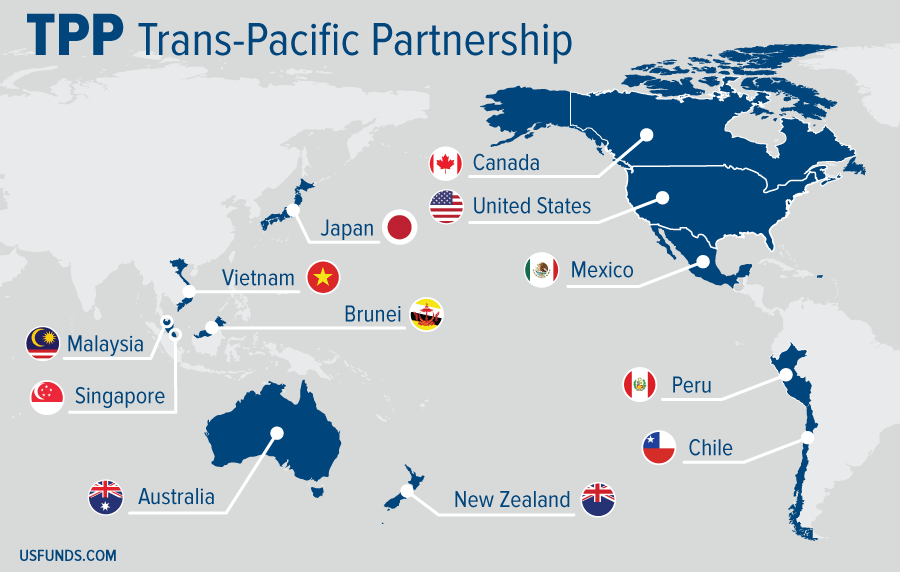

Chinese technology start-ups are pivoting to Southeast Asia and away from the United States in their expansion plans, in a clear bid to avoid getting in the midst of a trade war that is intensifying.

In a recent trip to Asia, Betty Liu, an executive at the New York Stock Exchange, said that she saw entrepreneurship continued to be “rocking” there. But the businesses are also increasingly looking at growth in Southeast Asia.

“Southeast Asia is one of those areas where it has been explored before, but now there is that new focus,” said Liu, executive vice-chairwoman of the exchange, to the South China Morning Post.

In Chinese entrepreneurs' minds, she said, “it's tough with the United States right now, so they're looking at the Southeast Asian markets as another area that can help them diversify beyond perhaps focusing only on the US or focusing only on Europe and other more developed markets.”

That shift would potentially constitute a challenge for US markets to draw more listings from China-based companies, a growth engine for the exchange, in coming years should trade tensions continue.

Chinese tech companies have been going public at a faster pace in recent years. As of Friday, 58 Chinese tech companies raised a total of more than US$20 billion this year, accounting for about a third of the total amount of capital sold to investors by tech companies globally, according to data provider Dealogic.

More often than not, however, Chinese tech companies chose to list elsewhere. Just 21 raised a little more than US$6 billion through US public offerings in the same period, Dealogic data show.

Other markets are vying for China’s tech companies, posing more competition. The Hong Kong stock exchange, for example, has in recent years loosened its listings rules to attract some of the tech sector’s biggest initial public offerings.

In July, the Chinese smartphone company Xiaomi debuted in Hong Kong in a US$3 billion listing. Meituan Dianping, an online food delivery-to-ticketing services platform, was also listed in Hong Kong in a US$4 billion IPO in September.

To be sure, the NYSE, the world’s largest stock exchange by market capitalisation, continues to draw a number of large Chinese companies from China. That included in September the electric-vehicle maker NIO, which raised US$1 billion in its listing.

And Tencent’s music-streaming business, a highly anticipated Chinese tech venture, just debuted on the exchange on Wednesday, raising US$1.1 billion.

But some recent debuts drew underwhelming responses, leading US investors to worry whether the sector is going to hold its valuations as a trade war between the two countries continues to escalate.

Since July, the US and China have slapped tariffs on billions of dollars worth of imports from each other. The moves have dragged down next year’s growth prospects for both nations.

Investors are particularly worried about Chinese technology companies because the two countries are racing to achieve a global dominance in the sector, in areas like artificial intelligence, robotics and life sciences.

Additionally, intellectual property theft is believed to be the thorniest part of the negotiations US President Donald Trump raised with his Chinese counterpart Xi Jinping.

“That's a really good example of how you've got the macro environment which is the US trade relations. Certainly any CEO would not be doing their job if they were not looking at what was happening in the environment and reassessing their plans,” Liu said.

The bright side? “It looks like both sides are negotiating now. There is this 90-day deadline so there is a time frame. And you know there's nothing like a deadline to get people to come to both sides and really try to iron out a compromise,” she noted.

“Both sides understand that there is a very strong relationship here, no matter how tense it has been.”

https://www.scmp.com/news/article/21781 ... -asia-amid

<3

ATTACK MODE

Comey Blasts GOP, ‘Lying’ Trump: ‘At Some Point Someone Has to Stand Up’

‘In the face of fear of Fox News, fear of their base, fear of mean tweets, stand up for the values of this country and not slink away into retirement,’ the ex-FBI director said.

Former FBI Director James Comey went after President Donald Trump and Republican members of Congress on Monday after emerging from a closed-door interview with House members, accusing the GOP of “shameful” silence in the face of the president’s attacks on the FBI.

“People who know better, including Republican members of this body, have to have the courage to stand up and speak the truth, not be cowed by mean tweets or fear of their base,” Comey told reporters. “There is a truth, and they’re not telling it. Their silence is shameful.”

He later added: “Some day they’ve got to explain to their grandchildren what they did today.”

Comey appeared on Monday before the House Judiciary and Oversight committees for the second time this month. Republicans, who control the House of Representatives for just a few more weeks, have been investigating the FBI’s handling of the federal investigations involving the Trump campaign and Hillary Clinton’s emails, dating back to 2016.

“So another day of Hillary Clinton’s emails and the Steele dossier,” Comey said dismissively after the interview, referring to former British spy Christopher Steele’s document alleging connections between Trump and Russia.

“This, while the president of the United States is lying about the FBI, attacking the FBI, and attacking the rule of law in this country–how does this make any sense at all?” he added.

“Republicans used to understand that the actions of a president matter, that words of a president matter, the rule of law matters, and the truth matters. Where are those Republicans today?” he said. “At some point, someone has to stand up, and in the face of fear of Fox News, fear of their base, fear of mean tweets, stand up for the values of this country and not slink away into retirement.”

Comey also dismissed Republican criticisms of how the FBI handled its interview of Michael Flynn, Trump’s former national security adviser who pleaded guilty to lying to the agency and has been cooperating with federal prosecutors.

“Oh come on,” Comey said with a laugh. “Think of what’s happening to the Republican party. They’re up here attacking the FBI’s investigation of a guy who pled guilty to lying to the FBI. ‘He should have been warned you shouldn’t lie. He should have been told you can have a lawyer.’ Think of the state of affairs we’ve ended up in. That’s nonsense.”

After Comey’s testimony, Rep. Mark Meadows (R-NC), a top Republican on the oversight committee and a staunch Trump ally, said Comey “didn’t follow protocol” with the agency’s interview of Flynn, and “treated different people by different rules,” citing the fact that Flynn was not warned in advance that it was a crime to lie to federal agents.

Flynn’s attorneys have claimed that the former national security adviser was coerced into lying to the FBI about his conversations with then-Russian ambassador Sergei Kislyak, but special counsel Robert Mueller’s prosecutors fired back, writing: “Nothing about the way the interview was arranged or conducted caused the defendant to make false statements to the FBI.”

Comey had asked for his testimony to be in public, but Republicans sent Comey and his attorneys a subpoena earlier this month to compel him to testify in private. The two sides later agreed that Comey would speak with lawmakers behind closed doors, but that a transcript of the testimony would be released the following day.

Democrats have accused Republicans of using their perches on powerful congressional committees to protect Trump and to attack the credibility of his adversaries.

https://www.thedailybeast.com/comey-bla ... p?ref=home

<